Indigenous Real Estate Investment Trust (I-REIT)

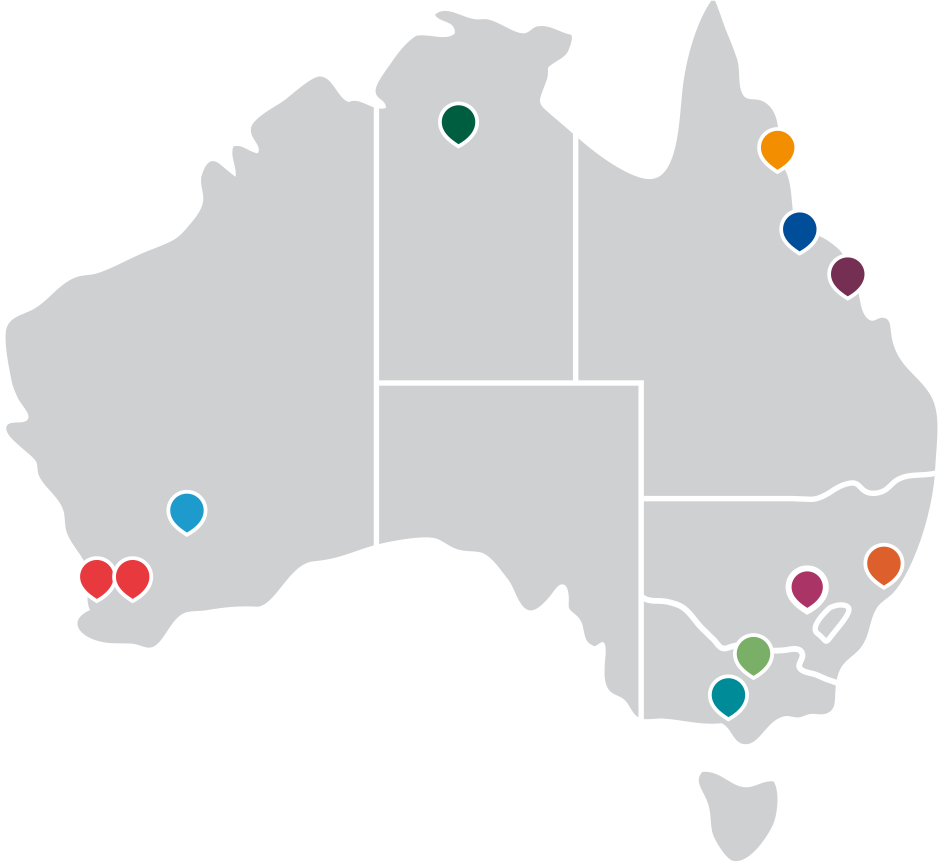

The I-REIT is an Australian, unlisted unit trust investing primarily in a portfolio of Australian commercial properties in four key sub-sectors; office, industrial, neighbourhood shopping centres and highway service stations. As at 15 April 2024 the portfolio comprises 11 assets providing a wide variety of accommodation for a range of different tenants, with further acquisitions planned.

By investing in the I-REIT, Indigenous investors derive an income stream and capital growth generated by the I-REIT's geographically diversified portfolio of commercial properties. Commercial property is a significant asset class that usually forms part of a diversified investment portfolio. A key benefit of the I-REIT for Indigenous organisations is access to returns from a range of properties that would otherwise require a very large capital outlay and incur significant acquisition costs.

In addition to financial returns, the Fund has sought to generate employment and supply chain outcomes for Aboriginal and Torres Strait Islander people through its property and facilities management arrangements.

Investments into the I-REIT and redemptions from the I-REIT can only be considered during approved trading windows. For more information about the I-REIT including the timing of trading windows please contact Investor Relations.

The Investment Manager

The Investment Manager of the I-REIT is IBA Asset Management Pty Ltd (IBAAM), a wholly-owned subsidiary of IBA. The Investment Manager has a majority of independent board members who bring significant experience in investment, governance and Indigenous affairs.

The Investment Manager undertakes the day-to-day management of the I-REIT, monitors the portfolio and identifies and conducts due diligence in relation to new investments or divestments.

The Investment Manager, in consultation with the Investment Committee (see below), intends to maintain a diversified portfolio whilst avoiding a concentration of characteristics that it believes may expose the I-REIT to excessive risk.

In addition to the I-REIT, the Investment Manager manages the Indigenous Prosperity Funds (IPF). The IPF provide eligible Aboriginal and Torres Strait Islander investors(1) with the opportunity to invest in a diversified portfolio of investments including exposure to Australian and international shares, bonds, property and cash. Further information regarding the IPF may be obtained here.

Investment Committee

The Investment Committee, comprised of a majority of independent professionals who approve key matters including:

- acquisitions and divestments;

- new leases or lease renewals that constitute 30% or more of the gross revenue of the relevant Property;

- debt finance facilities;

- material redevelopment or refurbishment of a property; and

- certain related party transactions.

Investment Strategy

The objective of the I-REIT is to generate attractive risk-adjusted returns to Unitholders over the medium to long term through exposure to a portfolio of commercial properties located in Australia.

Specifically, the Investment Manager will focus on commercial property investments that broadly have the following characteristics:

- a yield commensurate with the risk of the investment;

- the potential for capital growth over the medium to long term;

- a value of between $10 million and $20 million per investment; and

- are located in population catchments in excess of 15,000 people.

Properties

The information under each property description on this website is correct as at 15 April 2024.

106 High Street, Shepparton VIC

New building with secure car parking in the centre of Shepparton commissioned by the Victorian Government for its occupation. Comprises a 3-level office building with large floor plates on the upper floors having a total lettable area of 2,276 sqm and parking for 49 vehicles.

Fully occupied by the Victorian Government on a 10-year lease from June 2023.

2276 m2

Big Rivers Government Centre, 5 First Street, Katherine NT

Office building with secure parking located in the centre of Katherine. Dates from the mid 1980’s and recently underwent a whole of the interior refit with an additional passenger lift installed. Lettable area of 4,580 sqm is arranged as two very large floor plates of circa 2,250 sqm each with 104 car bays. Fully occupied by Northern Territory Government on a new 15- year lease from August 2023.

4,580 m2

Twin Highway Service Centres, Forrest Highway, West Pinjarra WA

A pair of service centres opened in 2017 catering to passenger vehicles and trucks, positioned on either side of the Forrest Highway approximately 88 kilometres south of the Perth CBD.

Almost identical designs with the service stations leased to Ampol on 20-year leases from September 2017, supported by three food court tenancies and providing customer parking for more than 100 vehicles.

2,937 m2 (South Pinjarra)

2,937 m2 (North Pinjarra)

10.4 years (North Pinjarra)

Amart Furniture, 40 Edward Street, Wagga Wagga, NSW

A freestanding bulky goods retail store with ancillary warehouse opened in 2018 in central Wagga Wagga on a prominent highway location in close proximity to the main shopping area. Provides 5,504 sqm of showroom and warehouse space with customer parking for 73 vehicles. Fully leased to Amart Furniture Pty Ltd for a 10-year term from March 2018.

5,504 m2

Clifton Village Shopping Centre, Corner Endeavour Road & Captain Cook Highway, Clifton Beach, Cairns QLD

Major enclosed neighbourhood shopping centre with undercroft car park located in the Cairns northern beaches next to Palm Cove, approximately 22km from the city centre.

Clifton Village is anchored by a Coles Supermarket, which recently underwent an extensive refit and committed to a new 10-year term from July 2024, and is supported by 24 specialty stores and kiosks. There are also 2 freestanding buildings which include a BP fuel-anchored convenience centre with 4 tenants and a pad site leased to a gym. Parking provision is for around 359 cars with 304 bays being undercover.

7,905 m2

Warabrook Shopping Centre, 3 Angophora Drive, Warabrook NSW

Comprises a well-established single level neighbourhood centre located on the Pacific Highway between Newcastle and Mayfield and constructed circa 1993 with a lettable area of 4,333 sqm and parking for 213 cars. The centre is anchored by a Woolworths supermarket with a new 5-year term from September 2024, supported by specialty stores that include a medical centre, pharmacy, pathology, newsagent, male and female hairdressers, and sushi and kebab shops. In addition there is a freestanding petrol and convenience store.

Walkerston Shopping Centre, 8 Creek Street, Walkerston QLD

Comprises a single level neighbourhood shopping centre located 15km west of Mackay which commenced trading in 2006 and has a lettable area of 3,264 sqm and parking for 179 vehicles.

The centre is anchored by a Woolworths supermarket supported by five speciality stores comprising a council library, butcher and seafood outlet, pizza shop, Asian hot food takeaway outlet and liquor store.

3,264 m2

520 Flinders Street, Townsville QLD

Multi-tenanted office building situated in the Flinders Street West precinct of Townsville and positioned next to buildings occupied by the ATO, Southern Cross University and a new development fully committed to Telstra at completion. Dating from 2008 the property provides two levels of offices, ground floor retail and offices and basement car parking for 35 vehicles.

The Commonwealth of Australia

28 Edgerton Road, Mitcham VIC

Located 22 km east of Melbourne CBD off the Maroondah Highway and close to the M3 Eastlink, the property dates from 2012/13 and comprises a single level showroom/office plus car parking for 68 vehicles. The property is fully leased to Versalux Lighting Systems Pty Ltd for a 10-year term from September 2017.

43 Boulder Road, Kalgoorlie WA

Comprises a 2-level office building with secure car parking positioned on the edge of Kalgoorlie CBD. Dating from around 2004 the property provides office accommodation on ground and first floor and secure parking plus visitor parking for 38 vehicles. The property is fully leased to the Commonwealth Government and an Indigenous health service provider.

883 m2

- in which at least 50% of the beneficial interests are held by Aboriginal or Torres Strait Islander people; and/or

- that furthers the economic, social or cultural development of Aboriginal or Torres Strait Islander people; and

- c. that is a Wholesale Investor (as defined in section 761G of the Corporations Act) making an initial investment of at least $500,000 (unless a lower amount is approved by the Trustee).